Make a Gift Now

Hilltop’s sustainability and growth is thanks to the donation of time, expertise, and resources from families past, present and future. Hilltop’s growth and success has been possible because of the culture of giving – in its many facets transforming from a one-room classroom to the thriving, multi-program campus it is today.

Other Ways to Donate

Mail a check directly to our Director of Development, Cristina Piergentili. All checks should be made out to Hilltop Montessori School.

Mailing Address:

Hilltop Montessori School

Attn: Cristina Piergentili

99 Stafford Farm Hill Road

Brattleboro, VT 05301

Find us @HMS1972 under Charities or search Hilltop Montessori School.

Find us @Hilltop Montessori School, Inc

Did you know that you can support our nonprofit directly from your Individual Retirement Account (IRA)? If you’re 70½ or older, you can make a Qualified Charitable Distribution (QCD) that counts toward your required minimum distribution (RMD) without increasing your taxable income.

Benefits of a QCD:

How to Make a QCD:

Our Information:

If you have any questions or need assistance, please reach out to Cristina Piergentili, Development Director, at [email protected]. Your support through an IRA rollover not only helps us but also offers you significant tax advantages. Thank you for considering this impactful way to give!

A Flexible and Efficient Way to Support Our Mission

Donor-Advised Funds (DAFs) offer a simple, tax-efficient way to support our nonprofit. By recommending grants from your DAF, you can make a meaningful impact while enjoying flexible giving options.

What is a Donor-Advised Fund?

How to Give Through a DAF:

Our Information:

Benefits of Using a DAF:

Next Steps:

Thank you for considering a grant from your Donor-Advised Fund. Your thoughtful giving helps us continue our important work and make a lasting impact.

Ensure Your Impact Lives On

Leaving a gift in your will to our nonprofit is a powerful way to ensure your legacy endures and continues to support the causes you care about. There are several ways to include our organization in your estate planning, each offering unique benefits.

Ways to Leave a Gift:

Next Steps:

For more information or assistance, please reach out to Cristina Piergentili, Development Director, at [email protected]. Your thoughtful planning can create a lasting legacy and make a significant impact on our mission. Thank you for considering us in your estate plans.

Turn Investments into Good Deeds

Donating stock to our nonprofit is a smart and impactful way to support our mission. By transferring appreciated securities, you can make a significant contribution while enjoying substantial tax benefits.

Benefits of Donating Stock:

How to Donate Stock:

Next Steps:

Our Contact Information:

Thank you for considering a stock donation. Your generous support helps us continue our vital work and create lasting change.

At Hilltop, your time is as valuable as any financial contribution!

Please contact our Director of Development, Cristina Piergentili, with any questions regarding donating to Hilltop.

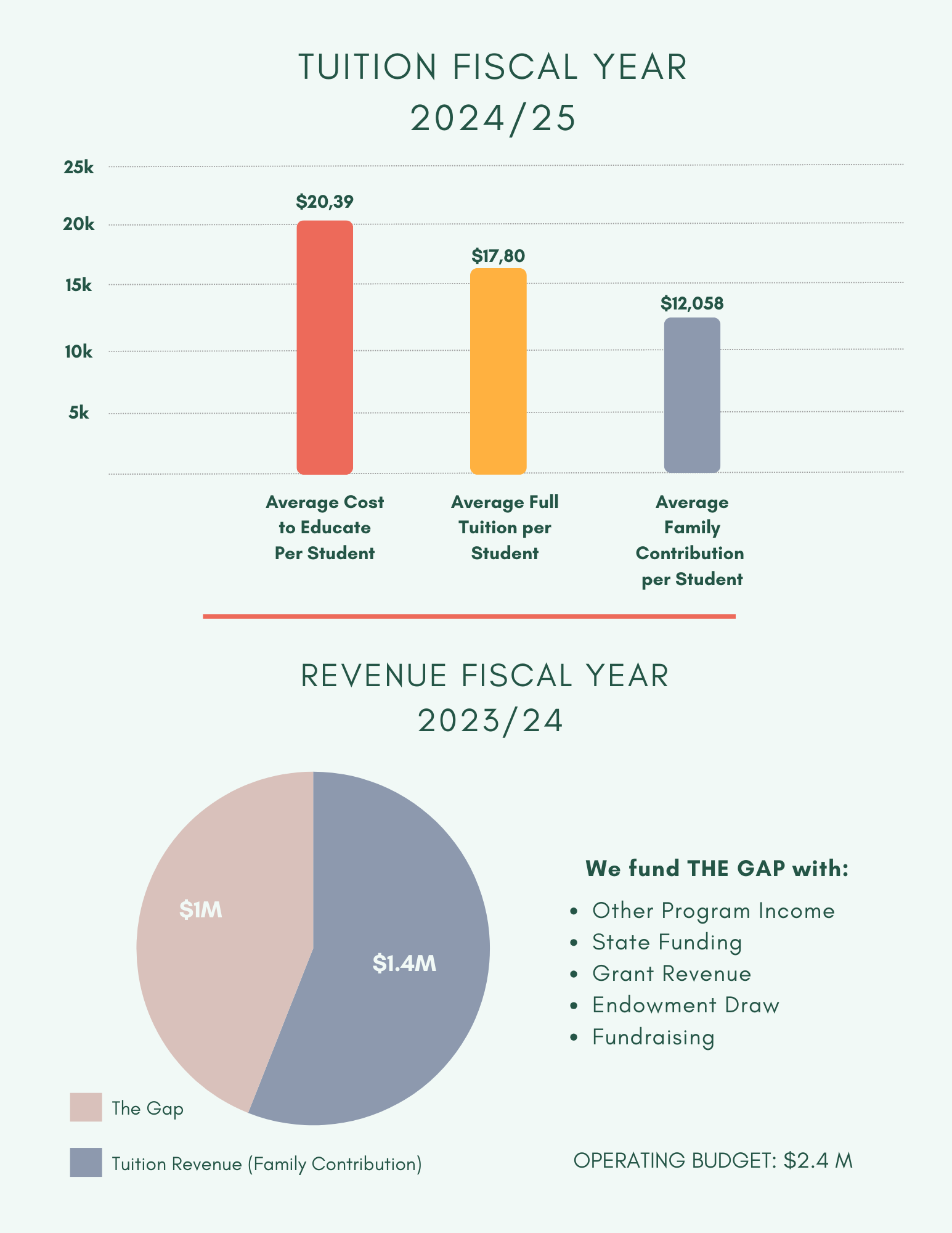

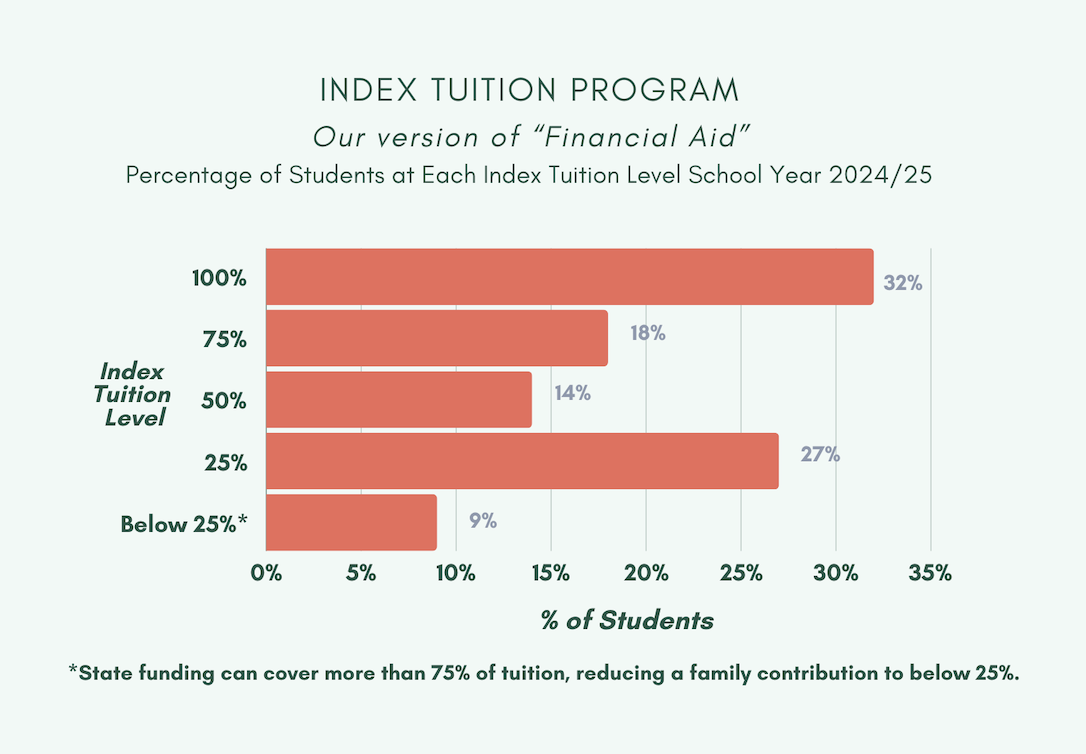

Why Give to Hilltop

As Maria Montessori said, “An education capable of saving humanity is no small undertaking…”, and it has been at Hilltop’s core to bring an education ahead of its time to Brattleboro and the surrounding community to create the generation of tomorrow. To help realize this vision, this coming year Hilltop is offering over $600,000 in school grants this year to ensure our school is affordable and accessible to more families who strive to give an authentic Montessori education to their child. We look for various ways throughout the year to make up this deficit through fundraising, and hope you can help participate in helping us meet our annual fundraising goals – whether it be through time, expertise, or resources – so we can continue to bring an exceptional Montessori education to the Brattleboro and surrounding community.

School Year 2024-25: The Financial Picture at a Glance